Running an ecommerce business is more than just selling products online. You need to have a firm grasp of your finances and bookkeeping—which all starts with your accounting practices.

This in-depth guide covers everything you need to know about ecommerce accounting, including its importance, benefits, quick tips, and long-term best practices for success.

Why Ecommerce Accounting Is So Important

It’s impossible to accurately manage your finances and make sound money decisions if your accounting records aren’t in order. From organizing your payables and receivables to keeping track of your transactions and managing supplier invoices, there’s a lot to handle.

Early on, new ecommerce businesses might manage this stuff by hand or using a spreadsheet. But that’s not a scalable solution. You should have your ecommerce accounting systems in place from day one—making it easier for your business to scale.

Having a firm grasp of your ecommerce accounting systems means you will always know the financial state of your business. You can use this information to make financially sound decisions, like whether it makes sense to invest more money into marketing or expand your offerings.

You can use ecommerce accounting reports and cash flow statements to predict both short-term and long-term revenue.

Gaining control over your ecommerce accounting systems is also crucial for tax reporting and compliance. Having the right systems, processes, and technology in place ensures that you’re paying and reporting the right taxes to the appropriate agencies—avoiding the headaches and penalties associated with non-compliance.

Once your ecommerce accounting solutions and policies are in place, you can spend less time on bookkeeping and more time growing other parts of your business.

Here’s a quick summary of a case study from Pro Compression—an ecommerce retailer that sells compression socks and sleeves for running, traveling, and work.

The brand was looking for a better way to get full visibility into its finances. They needed a way to track trends and make data-driven decisions.

Pro Compression ultimately synced QuickBooks Online with their sales records. This allowed them to view all transactions and performance in real-time. Since the change, the company has been able to forecast sales and uncover new opportunities for growth.

Quick Tips to Improve Ecommerce Accounting Today

Effective ecommerce accounting all starts with the right tools. Whether you’re starting a new ecommerce store from scratch or you have an existing business that you’re trying to improve, you need to have a solid accounting solution.

QuickBooks is one of the most popular accounting tools on the planet, and they offer solutions specifically for ecommerce accounting—QuickBooks Commerce.

QuickBooks makes it easy for any ecommerce shop to automate accounting processes and scale with ease.

The tool handles everything you could possibly need from an accounting standpoint. You’ll benefit from automated transaction tracking, tax help, cash flow insights, profit and loss reports, balance sheets, and more.

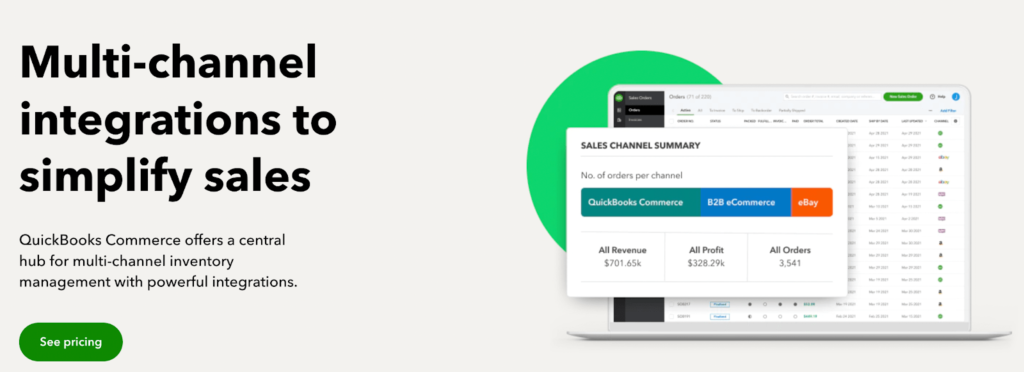

QuickBooks supports multi-channel integrations for online sellers, order management, and B2B ecommerce.

It easily syncs with all major ecommerce tools like Shopify, Amazon, eBay, Woo Commerce, Squarespace, and more. It even works with solutions like ShipStation and Zapier.

In addition to finding the right ecommerce accounting solution, there are some other quick tips that you can focus on right now to make your life easier. Even if you’re a complete beginner, these quick tips are easy to implement.

Tip #1 — Use Cash Basis Accounting

There are two types of ecommerce accounting methods for you to choose from—cash and accrual.

Each method has its pros and cons. But for the vast majority of beginners, cash basis is easier to understand and maintain.

The cash method is simple. New records are added to your accounting system whenever the transaction takes place. Sales are tracked when cash hits your bank account, and expenses are tracked when cash leaves your bank account.

This will also make your life easier come tax season, as you won’t have to pay income taxes on payments that haven’t been received.

The only downside of cash basis accounting is that it does not account for future receivables and payables. But if you’re using the right ecommerce accounting tools, you can still plan for these using other reports at your disposal.

With accrual accounting, you record each translation when it happens—regardless of when the money actually reaches or leaves your bank account.

All accounting tools support both methods. But for beginners, sticking with the cash method will make your life easier.

Tip #2 — Track and Categorize Expenses and Transactions

Every transaction on your books needs to be tracked. To keep things simple, you can look at each transaction as either income or an expense.

Accounting tools like QuickBooks will do this for you automatically. But you can improve your recordkeeping by adding supporting documents to each transaction.

This might sound like something tedious or difficult. But it’s actually really easy. Using the expense tracking tools from QuickBooks, you can do this in seconds.

You can snap pictures of receipts using the QuickBooks mobile app or simply upload your receipts and invoices through the software. QuickBooks will automatically sync those receipts with the transactions.

Not only does this help you stay organized, but it also helps you save money on taxes.

The software automatically sorts each expense into the appropriate category, so you never miss an opportunity for tax deductions.

In addition to your ecommerce software, QuickBooks also syncs with your business accounts. You can integrate the tool with your bank accounts, credit card accounts, and even your payment processing accounts.

Tip #3 — Sync All of Your Sales Channels

Most ecommerce businesses sell products on multiple platforms and channels.

At a minimum, you likely have a website or mobile app that you’re using. But you might also be selling through Amazon, eBay, Etsy, social media, and other third-party platforms. Even if you’re not a multi-channel ecommerce seller right now, you might scale to these additional channels sometime in the near future.

While selling through multiple channels is a great way to increase your reach, it can sometimes be a pain from your accounting standpoint. Without the right tools, you’re forced to collect and reconcile all of your transactions from each platform separately, which is time-consuming and leaves too much room for error.

QuickBooks makes it possible to sync all of the transactions and records from each sales channel into a single source of truth.

This makes it easy for you to see which channels are thriving at-a-glance. You can also view all of your sales records at once instead of manually adding them together.

Tip #4 — Automate Tax Calculations

Taxes can drive business owners nuts. The ecommerce category is no exception to this.

Many ecommerce stores struggle with appropriate tax record keeping because there are so many different rules to follow.

Depending on what you’re selling and where you’re selling it, you’ll likely need to pay taxes to multiple agencies in different jurisdictions.

For example, most ecommerce stores need to pay federal income taxes, state income taxes where the business is located, and state income taxes where the customer is located.

In some scenarios, you may even need to pay taxes wherever your company has a physical presence. So if you have a factory in one state, but your headquarters is in another, you likely owe taxes in both places.

Trying to keep track of all this stuff on your own is not reasonable or realistic.

Fortunately, most of the best ecommerce platforms offer a way to manually track your tax liabilities. Some even provide you with tax reporting documents to file with the appropriate parties. Shopify is our top recommendation in this category, and the software has excellent tax automation tools for ecommerce businesses.

Tip #5 — Know the Difference Between Chargebacks and Returns

Chargebacks and returns are not the same things. They need to be tracked and categorized separately from an accounting standpoint. This is a common error that many ecommerce stores make.

Both of these transactions are expenses because they each result in money leaving your bank account.

Your return policy will have an impact on how returns are documented in your accounting records.

For example, if you’re giving customers a full refund, you can categorize the transaction as a “return and allowance” once it’s back in your possession. Then you can subtract the cost directly from your revenue. For store credits, the original transaction amount can be changed to an expense and added to the accounts payable list.

Chargebacks are different. This is when a customer disputes a transaction directly with their bank or credit card company.

The money is pulled out of your account, along with extra fees and potential penalties imposed by your bank and processor.

Chargebacks are also categorized as a “return and allowance.” However, you need to make sure that the extra fees associated with the chargeback are also marked as an expense.

This simple tip will make your life much easier as you’re recording and reconciling your transactions.

Long-Term Strategies For Ecommerce Accounting

In addition to the quick tips mentioned above, there are a few more ecommerce accounting strategies that you need to consider. These will take a bit longer to implement, but they’re crucial for the long-term health and success of your ecommerce operation.

Strategy #1 — Run and Analyze Detailed Accounting Reports

Organized and accurate record keeping is just one aspect of ecommerce accounting. You should also be running reports and reviewing the information in those reports on a regular basis.

You can use QuickBooks to run standard reports or customize the reporting tools based on what information you’re trying to uncover.

Examples of custom reports you can run with QuickBooks include:

- Historical inventory reports

- Incoming stock reports

- Stock on hand reports

- Inventory location reports

- Sales by channel reports

- Inventory detail reports

- Sales by time period reports

- Sales by product reports

This type of information can help you figure out which products are generating the most revenue and which sales channels are your most profitable. You can also use the historical data and sales by time period reports to make future sales predictions.

This isn’t something you need to do every day. But at a minimum, you should be analyzing reports on a monthly or quarterly basis.

Strategy #2 — Track Your Cash Flow

Sometimes sales metrics and bank account balances alone can be deceiving. They don’t show the full picture when you’re making important financial decisions for your ecommerce store.

Cash flow statements will help you truly understand how all financial activities are being managed.

You’ll see who is paying money to the business and where money is being spent.

If you don’t have a firm grasp of your cash flow, it could be disastrous for your business. Cash flow statements help you understand whether or not your ecommerce sales are generating enough money to cover debts and operating expenses.

Tracking and reviewing your cash flow every month will help you identify problems before they become a bigger issue. Then you can cut expenses where it’s necessary to maintain adequate cash both short and long-term.

Strategy #3 — Implement Scalable Ecommerce Accounting Policies

All of your ecommerce accounting systems and policies should be formally documented. Even if you’re using software to automate things, you should still have an accounting system that’s easy to scale.

Imagine if your ecommerce sales quadrupled during the holiday season. You don’t want this amazing news to result in an accounting nightmare.

What happens if you want to expand and start selling on new channels? Can your accounting system handle this?

Make sure you’re reviewing the policies and making the appropriate adjustments on a regular basis. This ensures that you and your team are equipped to handle an influx of sales and platform expansions.

Always prepare for the long-term when you’re making ecommerce accounting decisions.

Next Steps

Now that you understand the importance of ecommerce accounting, the first thing you need to do is get the right software. QuickBooks will make your life easier and help you implement both the quick tips and long-term strategies that we covered in this guide.

You should also be using ecommerce software that’s compatible with your accounting solution. Some online sales systems even have built-in ecommerce accounting tools. Use our list of the best ecommerce platforms for additional guidance.