Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

Is your business in good standing with your state? You can’t answer this question truthfully without a certificate of good standing.

This in-depth guide will explain the importance of a certificate of good standing, along with tips and strategies for obtaining one.

Why Getting a Certificate of Good Standing Is So Important

A certificate of good standing is a state-issued document indicating that a company is registered with the state and authorized to conduct business. Depending on the state or specific scenario, the document may also be called:

- Certificate of Authorization

- Letter of Good Standing

- Certificate of Existence

- Certificate of Status

- Certificate of Facts

It’s worth noting that a certificate of good standing is not a business license or occupational license. An organization can legally conduct business in a state where it’s registered without getting a letter of good standing.

However, failing to obtain a certificate of good standing can hold your business back in many instances. While a certificate of good standing isn’t necessarily a requirement, it may be requested in several different scenarios for conducting business.

For example, a bank might ask for a certificate of good standing before you can open a business bank account. If you’re seeking a loan or raising capital from outside investors, lenders or investors might ask for a certificate to ensure your business is authorized to operate. A letter of good standing may even be required to obtain insurance, process credit cards, or enter a contract with another business.

As you can see from the wide range of circumstances, having a valid certificate of good standing is necessary to operate your business. Without one, you might miss out on lots of opportunities.

It’s common for certificates of good standing to have an expiration date. This could range anywhere from 30 days to 90 days or more.

Here’s a quick story to highlight the importance of a certificate of good standing:

Craft Electric is an electrical contractor based in Alabama. After landing a big project with a construction and design company, Craft Electric had an opportunity to expand its operation in other states.

To capitalize on the new proposal, Craft Electric needed licenses in Texas and Nevada. They didn’t know where to start and ended up hiring a business compliance service provider to assist the company in getting everything they needed. After filing the appropriate paperwork in each state, securing a registered agent, obtaining licenses and certificates of good standing, Craft Electric was able to expand. Now, Craft Electric is expanding even further to other states.

Quick Tips For Getting a Certificate of Good Standing Today

Do you need a certificate of good standing? These simple tips below will make that happen quickly.

Tip #1 — Verify That You Actually Need a Certificate of Good Standing

As previously mentioned, certificates of good standing aren’t always a requirement. They also have expiration dates. So while it’s great to be proactive, you don’t necessarily need to have one on-hand at all times unless it’s been requested for a particular situation.

If you’re running a business as a sole proprietorship, you aren’t required to register your business with the state. For those who fall into this category, you don’t need to worry about a certificate of good standing unless you’re planning to form an LLC or corporation.

All LLCs and corporations are required to register with the state. The requirements for business entities like LLLPs (limited liability limited partnerships), LLPs (limited liability partnerships), LPs (limited partnerships), and partnerships vary from state to state.

Examples of situations when you might need to obtain a certificate of good standing include:

- Obtaining or renewing a business license or permit

- Getting insurance for your business

- Applying for a business loan

- Opening a new business bank account

- Applying for foreign qualification to operate in another state

- To secure a contract with a potential client, partner, or vendor

- When applying for a government contract or government-backed loan

- Getting a new system to process credit cards or debit cards

If you don’t need to register with your state, nobody is requesting a certificate of good standing, and you don’t have any of these plans in the foreseeable future, then you don’t need to worry about getting one right now, as it will simply expire before you have a chance to use it.

Tip #2 — Research the Fastest Way to Get a Certificate of Good Standing

When the day comes where a certificate of good standing is required, you shouldn’t be scrambling to obtain one. You should know exactly where and how to get a letter of good standing. Any delays can cost you an opportunity.

The exact process and requirements vary from state to state. But every scenario involves a bit of work on your end and some paperwork to file.

A simple shortcut for getting a certificate of good standing is by going straight to a business compliance service provider. Harbor Compliance is perfect for this.

Harbor Compliance can request a certificate of good standing on your behalf within one business day of you reaching out. If necessary, they can expedite the process and even pick up the certificate in person to save time.

The cool part about Harbor Compliance is that they can accommodate a wide range of other compliance needs for your business.

You can use them for business licensing, annual reports, foreign qualifications, and they even offer registered agent services. That’s why more than 25,000 businesses rely on Harbor Compliance for various needs.

Tip #3 — Figure Out Where to Get a Certificate of Good Standing

If you don’t want to go through a third party to obtain your certificate, that’s fine. But you should know exactly where to get your certificate so that you’re prepared when the time comes.

Typically, you’ll obtain a certificate of good standing from the same state agency where you registered your business. This is usually the secretary of state office or a subdivision of that agency. Other states have different names for the agency where you get a certificate of good standing:

- Alaska — Department of Commerce, Community, and Economic Development

- Arizona — Arizona Corporation Commission

- Delaware — Division of Corporations

- Hawaii — Business Registration Division Department of Commerce and Consumer Affairs

- Maryland — Department of Assessments and Taxation

- Massachusetts — Secretary of the Commonwealth of Massachusetts Corporations Division

- Michigan — Department of Licensing and Regulatory Affairs

- New Jersey — Department of Treasury Division of Revenue and Enterprise Services

- Utah — Utah Department of Commerce, Division of Corporations and Commercial Code

- Virginia — State Corporation Commission

- Washington DC — Department of Consumer and Regulatory Affairs, Corporations Division

- Wisconsin — Department of Financial Institutions

To find the exact process for obtaining a certificate of good standing and the fees involved, go directly to the agency’s website in your specific state.

Tip #4 — Use Software to Stay Organized

Compliance is arguably the most significant component of a certificate of good standing. If your business isn’t compliant with the state, you won’t be able to obtain a certificate.

But there are so many things to keep track of that you can easily fall out of compliance unintentionally. Forgetting to file a report or forgetting to pay certain taxes are common occurrences if you’re trying to manage things manually.

You could easily forget to renew a particular business license if you’re relying on a hand-written note taped to your computer monitor.

The solution is simple—use compliance software to stay organized.

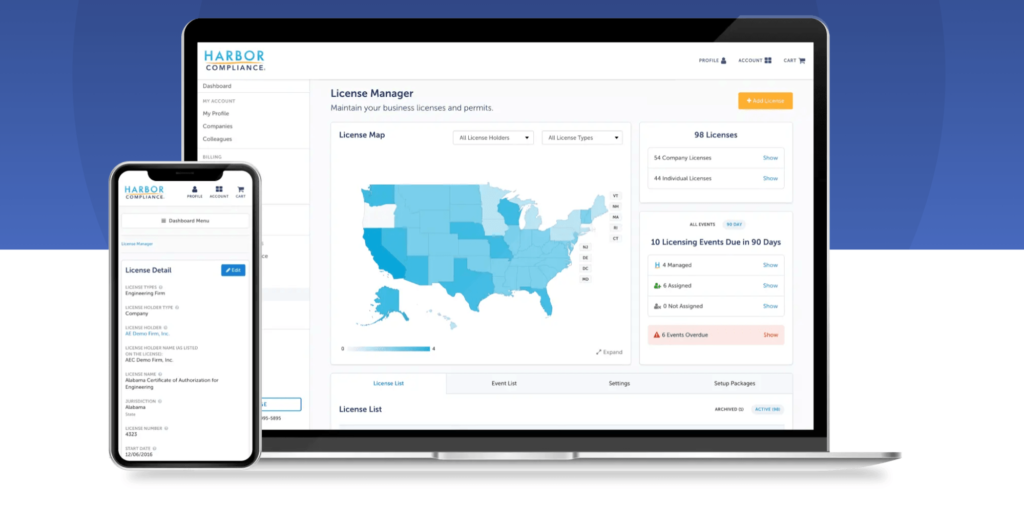

Harbor Compliance has everything you need to manage licenses, business records, registrations, and more through a user-friendly portal. The software includes a tax manager, entity manager, records manager, and other useful tools to remain compliant.

You can use the software for at-a-glance information on where you’re authorized to do business. This saves you a ton of time for tracking and researching compliance-related tasks.

Ultimately, Harbor Compliance can help you reduce risks related to licensing lapses and other critical operations requirements.

The software is an entirely different solution from the certificate of good standing service that we mentioned earlier. While we recommend using Harbor Compliance for both, you could always use them for one thing and not the other—it all depends on your preferences.

You can schedule a free demo to try it today and start taking steps towards compliance immediately.

Long-Term Strategies For Maintaining a Certificate of Good Standing

In addition to the tips mentioned above, there are some long-term strategies you need to apply if you want to maintain your certificate of good standing. While these strategies take a bit more time and effort, the payoff is well worth it.

Strategy #1 — Make Sure Your Business Remains Compliant With State Requirements

Compliance is a fairly broad term in the world of running a business, and the exact requirements vary from state to state.

To initially qualify for a certificate of good standing, your business must be compliant. But this isn’t just a one-time requirement. You’ll need to stay compliant indefinitely if you want to remain in good standing and renew your certificate.

So what obligations must you follow to remain compliant?

Generally speaking, you need to abide by all state, federal, and local licensing rules. Things like building licenses and health permits typically fall into this category.

You’ll also need to stay current on all state tax dues. From filing the proper forms to paying sales tax, unemployment insurance, withholding taxes, and more, this is a requirement to stay compliant.

Certain states also impose annual taxes, privilege taxes, or franchise taxes—a tax allowing the organization to continue operating business in the state. This is typically a flat fee or based on a percentage of the company’s revenue.

Many states require LLCs and corporations alike to file annual reports. These reports verify basic information about your business and summarize the company’s finances.

Maintaining a registered agent, obeying local zoning laws, following corporate rules (like meeting minutes and bylaws)—all of these fall into the compliance category.

This is just the tip of the iceberg of what’s required to remain compliant. Compliance isn’t something you can achieve overnight—it’s an ongoing process that you need to prioritize on a daily, weekly, and monthly basis.

Set reminders for when your licenses expire and when you need to file an annual report. This is another reason why it’s helpful to use services like Harbor Compliance for assistance.

Strategy #2 — Understand the Certificate of Good Standing’s Validity For Your Unique Use Cases

Again, most certificates of good standing expire after a while. So you can’t always use a general letter for every use case.

For example, a bank might require a certificate that’s been issued within 30 days. Another lender might be okay with a certificate that’s valid for up to 90 days. It completely depends on the state and the situation.

If you want to conduct business in a state that you’re not currently registered in, you need to register in the new state as a foreign entity and obtain a letter of good standing from your home state. Here’s when a certificate of good standing must be issued if you plan to register as a foreign entity in the following states:

- Within 30 days: Arkansas, Michigan, New Jersey, New Mexico, South Carolina, Vermont, Washington DC, and Wyoming

- Within 60 days: Arizona, Hawaii, Illinois, Indiana, Missouri, Alaska, New Hampshire, Oklahoma, Oregon, Rhode Island, Tennessee, and Wisconsin

- Within 90 days: Connecticut, Florida, Georgia, Idaho, Iowa, Kansas, Louisiana, Maine, Maryland, Massachusetts, Nevada, North Dakota, Ohio, South Dakota, and Washington

- Within six months: California, Delaware, Mississippi, Montana, Nebraska, and North Carolina

- Within one year: New York and West Virginia

Alaska, Colorado, Kentucky, Minnesota, Pennsylvania, Texas, and Alabama don’t require a certificate of good standing for foreign entities.

So if you’re planning to expand your operations outside of your home state, you need to consider this information and get a certificate of good standing that fits within these time frames.

Next Steps

Assuming you fall into one of the categories mentioned in this guide that requires a certificate of good standing, it’s time to request your letter. You could go straight to your state agency’s office or use a compliance solution like Harbor Compliance.

Paying your taxes is an important aspect of compliance related to good standing with your state. Check out our guide on the best accounting software to get help with calculating and paying those taxes.

Our list of the best payroll software and services also offers business compliance tools useful for obtaining a certificate of good standing.